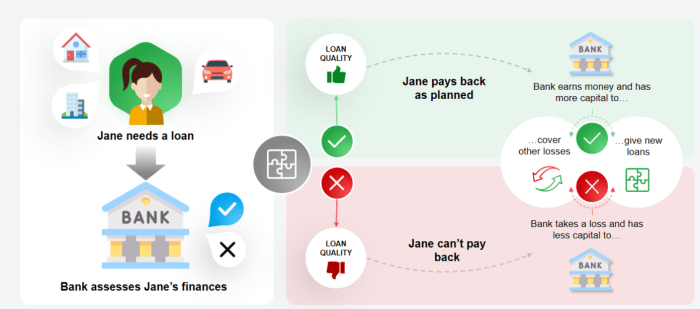

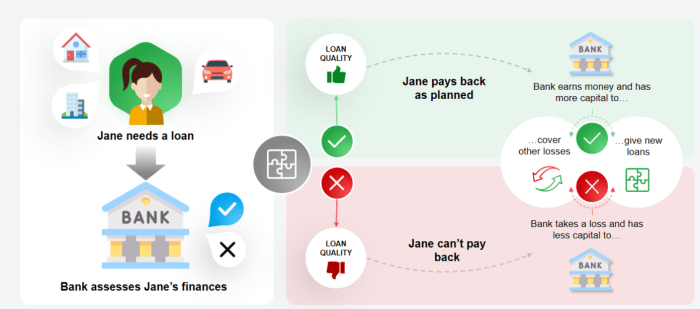

Securing a loan hinges on a critical factor often overlooked: credit risk. Lenders meticulously assess this risk, evaluating numerous aspects of an applicant’s financial history to determine their likelihood of repayment. This evaluation process, though seemingly complex, is crucial for both the borrower and the lender, ensuring responsible lending practices and financial stability for all parties involved.

This assessment involves a detailed examination of credit scores, payment history, debt levels, and other financial indicators. Understanding how these factors influence loan approval is paramount for individuals seeking financing and for lenders aiming to minimize potential losses. This exploration will delve into the intricacies of credit risk assessment, highlighting its significant impact on the loan approval process.

Defining Credit Risk in Loan Applications

Credit risk, in the context of loan applications, represents the potential for financial loss to a lender due to a borrower’s failure to repay their debt as agreed. This risk is inherent in any lending activity and is a primary concern for financial institutions. Effective assessment and management of credit risk are crucial for the lender’s profitability and stability.

Several factors contribute to the assessment of credit risk. Lenders meticulously examine various aspects of a borrower’s financial situation and credit history to gauge their likelihood of default. These factors include the borrower’s credit score, debt-to-income ratio, employment history, income stability, the purpose of the loan, and the loan amount itself. The type of collateral offered, if any, also plays a significant role.

A thorough analysis of these factors allows lenders to create a comprehensive risk profile for each applicant.

Types of Credit Risk

Lenders face several types of credit risk. Default risk, the most common, refers to the possibility that a borrower will fail to make timely payments on their loan. Concentration risk arises when a significant portion of a lender’s loan portfolio is concentrated within a specific industry, geographic area, or borrower segment, increasing vulnerability to systemic shocks. Downgrade risk involves the possibility of a borrower’s credit rating being lowered, increasing the likelihood of default and potentially impacting the value of the loan.

Prepayment risk, conversely, is the chance that a borrower will repay their loan earlier than expected, potentially reducing the lender’s anticipated income.

Quantifying Credit Risk

Lenders utilize various methods to quantify credit risk. One common approach is credit scoring, which uses statistical models to assign a numerical score to a borrower based on their credit history and other financial data. Higher scores generally indicate a lower risk of default. Another method involves calculating the probability of default (PD), which estimates the likelihood of a borrower failing to repay their loan.

This probability is often incorporated into sophisticated models to determine the expected loss (EL), which represents the estimated amount of loss a lender might incur from a default. Furthermore, lenders may use stress testing to assess the potential impact of adverse economic conditions on their loan portfolio. For instance, a lender might simulate a recession to see how many loans are likely to default under those conditions.

Credit Scoring Models

Several credit scoring models exist, each with its strengths and weaknesses. The choice of model often depends on the type of loan, the borrower’s characteristics, and the lender’s risk appetite.

| Model Name | Description | Data Used | Impact on Risk Assessment |

|---|---|---|---|

| FICO Score | Widely used consumer credit score in the US. | Payment history, amounts owed, length of credit history, credit mix, new credit. | Provides a standardized measure of creditworthiness, influencing loan approval and interest rates. |

| VantageScore | Another popular consumer credit score in the US, often used alongside FICO. | Similar to FICO, but incorporates additional data points and weighting. | Offers a complementary view of creditworthiness, potentially leading to more nuanced risk assessment. |

| Internal Credit Scoring Models | Developed by individual lenders based on their specific data and risk preferences. | Proprietary data, including historical loan performance, applicant-specific data. | Allows for tailoring risk assessment to the lender’s portfolio and target market. |

| Z-score Model | A financial distress prediction model that uses financial ratios to assess a company’s likelihood of bankruptcy. | Financial statement data (e.g., profitability, liquidity, leverage). | Primarily used for corporate lending and evaluating business creditworthiness. |

The Role of Credit Score in Loan Approval

Credit scores play a pivotal role in the loan approval process, acting as a crucial indicator of a borrower’s creditworthiness. Lenders rely heavily on these scores to assess the risk associated with extending credit, ultimately influencing their decisions regarding loan approval, interest rates, and loan terms. A strong credit score significantly increases the likelihood of loan approval and can lead to more favorable interest rates, while a weak score can result in loan denial or higher interest rates.Credit scores provide a standardized numerical representation of an individual’s credit history, allowing lenders to quickly compare applicants and assess their risk profile.

This streamlined process makes the lending decision more efficient and objective.

Impact of High Versus Low Credit Scores on Loan Approval and Interest Rates

A high credit score, typically above 700, significantly improves the chances of loan approval. Lenders view applicants with high scores as lower risk, leading to higher approval rates and often more favorable interest rates. For example, an applicant with a credit score of 750 might qualify for a loan with a 4% interest rate, while an applicant with a similar financial profile but a score of 650 might only qualify for a loan with a 7% interest rate, or even face loan denial.

Conversely, a low credit score, generally below 600, substantially reduces the likelihood of loan approval. Lenders perceive applicants with low scores as higher risk, resulting in lower approval rates and significantly higher interest rates if approved. They may also require larger down payments or stricter loan terms to mitigate the perceived risk. In some cases, a very low credit score can lead to outright rejection of a loan application.

Examples of Lender Use of Credit Scores in Lending Decisions

Lenders utilize credit scores in various ways throughout the loan approval process. For instance, a mortgage lender might use a credit score to determine the applicant’s eligibility for a specific mortgage product, setting interest rates based on the score’s range. Similarly, a credit card company might use a credit score to assess the credit limit they are willing to offer, potentially offering a higher limit to applicants with excellent credit scores.

Auto lenders often use credit scores to determine the interest rate on auto loans, with higher scores translating to lower rates. In all these examples, the credit score serves as a key factor influencing the lender’s decision-making process.

Key Components of a Credit Score Report and Their Influence on Risk Assessment

A credit score report comprises several key components that collectively contribute to the overall risk assessment. Understanding these components helps borrowers improve their creditworthiness.

The following points Artikel the key components and their influence:

- Payment History (35%): This is the most significant factor, reflecting the borrower’s consistency in making timely payments on credit accounts. A history of late or missed payments significantly lowers the credit score, indicating higher risk to lenders.

- Amounts Owed (30%): This component assesses the borrower’s debt levels relative to their available credit. High credit utilization (using a large percentage of available credit) suggests higher risk, negatively impacting the credit score.

- Length of Credit History (15%): A longer credit history generally indicates a more established credit profile, suggesting lower risk. Newer credit accounts can negatively impact the score until a longer history is established.

- New Credit (10%): Frequently applying for new credit can indicate financial instability and increase the perceived risk. Opening multiple new accounts in a short period can lower the credit score.

- Credit Mix (10%): This refers to the diversity of credit accounts held by the borrower (e.g., credit cards, installment loans, mortgages). A mix of credit types can sometimes positively influence the credit score, although it’s less significant than the other factors.

Impact of Credit History on Loan Approval Decisions

A borrower’s credit history is a crucial factor influencing loan approval decisions. Lenders meticulously examine this history to assess the applicant’s reliability and capacity to repay the loan. A strong credit history significantly improves the chances of approval, while a poor one can lead to rejection or less favorable loan terms. Understanding how lenders assess credit history is vital for both borrowers and lenders.Lenders use credit history to predict the likelihood of loan default.

Past behavior, including payment patterns, debt management, and any instances of bankruptcy, provides valuable insight into a borrower’s financial responsibility. This information is integrated with other factors, such as income and debt-to-income ratio, to create a comprehensive risk assessment.

Methods of Assessing Credit History

Lenders employ several methods to assess credit history. These methods ensure a thorough evaluation of the applicant’s financial past. The primary method involves obtaining a credit report from a credit bureau. This report provides a detailed overview of the applicant’s credit accounts, payment history, and any public records, such as bankruptcies or judgments. In addition to the credit report, lenders may also request additional documentation, such as bank statements or tax returns, to verify income and assets.

This supplementary information adds another layer of verification to the assessment process. Finally, lenders may use proprietary scoring models that weigh various factors within the credit history differently to reach a final credit risk assessment.

Credit History Review Flowchart

The following illustrates the typical steps involved in reviewing a credit history for loan approval. Each step is crucial in determining the applicant’s creditworthiness.[Imagine a flowchart here. The flowchart would begin with “Loan Application Received.” The next step would be “Obtain Credit Report from Credit Bureau.” This would branch into two paths: “Report Received” and “Report Not Received (Further Investigation).” The “Report Received” path would lead to “Analyze Credit Score and History.” This step would branch into “Positive Credit History” and “Negative Credit History.” “Positive Credit History” would lead to “Loan Approval (favorable terms).” “Negative Credit History” would lead to “Further Assessment (verification of income, assets, and explanation of negative marks).” This step would branch into “Acceptable Explanation/Improved Financial Situation” leading to “Loan Approval (potentially less favorable terms)” and “Unacceptable Explanation/Poor Financial Situation” leading to “Loan Denial”.

The “Report Not Received (Further Investigation)” path would lead to “Contact Applicant/Credit Bureau” and then loop back to “Obtain Credit Report from Credit Bureau”.]

Impact of Positive and Negative Credit History on Loan Terms

A positive credit history, characterized by consistent on-time payments, low debt utilization, and a long credit history, typically results in favorable loan terms. For example, a borrower with an excellent credit score might qualify for a lower interest rate, a longer repayment period, and potentially a higher loan amount. Conversely, a negative credit history, including missed payments, bankruptcies, or high debt utilization, often leads to less favorable terms.

This might involve a higher interest rate, a shorter repayment period, a lower loan amount, or even loan denial. For instance, an applicant with a history of late payments might be offered a loan with a significantly higher interest rate to compensate for the increased risk. Another example is a borrower with a bankruptcy on their record, who may only qualify for a smaller loan amount or a loan with stricter terms.

Credit Card Credit Risk and its Relation to Loan Approval

Credit card usage significantly influences the assessment of credit risk and, consequently, the likelihood of loan approval. Lenders meticulously examine credit card history to gauge an applicant’s responsible borrowing and repayment behavior. This information provides crucial insights into an applicant’s overall creditworthiness, supplementing data from other credit sources.Credit card usage, specifically utilization rates, directly impacts the perception of creditworthiness.

High utilization rates—the percentage of available credit used—signal to lenders a potential inability to manage debt effectively. This is because high utilization suggests a reliance on credit and a greater vulnerability to financial difficulties. Conversely, low utilization rates generally portray a more responsible approach to credit management, improving the applicant’s chances of loan approval.

High Credit Card Utilization Rates and Creditworthiness

High credit card utilization, typically exceeding 30% of the total credit limit, is viewed negatively by lenders. This indicates that the applicant is heavily reliant on credit and may struggle to make timely payments if faced with unexpected financial challenges. For example, an applicant with a $10,000 credit limit carrying a balance of $8,000 or more would be considered high-risk.

This significantly reduces their chances of securing a loan with favorable terms or even approval at all. Lenders often interpret high utilization as a potential sign of financial instability, increasing the perceived risk of default.

Risk Assessment: Multiple versus Few Credit Cards

The number of credit cards an applicant possesses also influences risk assessment. While having multiple cards isn’t inherently negative, it can raise concerns if managed poorly. An applicant with numerous cards carrying high balances on each demonstrates a higher level of debt and potential overextension of credit. Conversely, an applicant with few or no credit cards might indicate a lack of credit history, making it difficult for lenders to accurately assess their creditworthiness.

The ideal scenario often involves a manageable number of credit cards with consistently low utilization rates, demonstrating responsible credit management.

Lenders’ Use of Credit Card Information in Risk Assessment

Lenders utilize credit card information in several ways to construct a comprehensive credit risk profile. They analyze payment history, looking for instances of late or missed payments, which are significant red flags. They also examine the credit limits and outstanding balances on each card to calculate utilization rates. The length of credit history with each card also contributes to the assessment.

A longer history of responsible credit card usage generally strengthens the applicant’s credit profile, whereas a shorter history with inconsistent payment behavior can significantly weaken it. This comprehensive analysis allows lenders to build a holistic picture of the applicant’s credit behavior and overall financial responsibility.

Mitigation Strategies for High Credit Risk

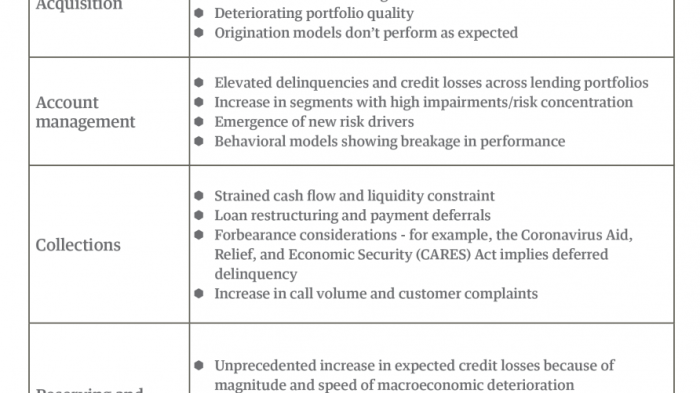

Lenders face significant challenges when assessing borrowers with high credit risk. However, various strategies exist to mitigate these risks and make informed lending decisions, balancing the need for profitability with responsible lending practices. These strategies aim to reduce the likelihood of loan default while still providing access to credit for those who may need it.

Adjusting Loan Terms to Manage Credit Risk

Lenders frequently adjust loan terms to reflect the level of credit risk involved. For borrowers with less-than-perfect credit histories, higher interest rates are often applied to compensate for the increased risk of default. This increased interest rate acts as a premium for the lender, offsetting the higher probability of loss. Similarly, lenders may reduce the loan amount offered, limiting their potential exposure.

The repayment schedule might also be adjusted, perhaps shortening the loan term to accelerate repayment and minimize the overall risk period. For example, a borrower with a low credit score might be offered a personal loan with a 15% interest rate, a smaller loan amount than initially requested, and a shorter repayment period of 24 months instead of the requested 60 months.

This adjustment aims to balance the risk with the potential for profit.

The Role of Collateral and Guarantees in Mitigating Credit Risk

Collateral and guarantees play a crucial role in mitigating credit risk. Collateral is an asset pledged by the borrower to secure the loan. If the borrower defaults, the lender can seize and sell the collateral to recover some or all of the outstanding loan amount. This could be a house for a mortgage, a car for an auto loan, or other valuable assets.

Guarantees, on the other hand, involve a third party agreeing to repay the loan if the borrower defaults. This third party typically has a strong credit history, thus reducing the risk for the lender. For instance, a small business owner seeking a loan might offer their business property as collateral, providing the lender with a tangible asset to recover in case of default.

Alternatively, a co-signer with a good credit history might guarantee a student loan, ensuring repayment even if the student is unable to make payments.

Strategies for Borrowers to Improve Creditworthiness

Improving creditworthiness is crucial for securing loan approval at favorable terms. A strong credit history significantly increases the likelihood of loan approval and reduces the interest rates and fees charged. Several strategies can help borrowers enhance their credit profile.

- Pay bills on time: Consistent and timely payments are the cornerstone of a good credit score. Late payments negatively impact credit scores, making it harder to secure loans.

- Keep credit utilization low: Maintaining a low credit utilization ratio (the amount of credit used compared to the total available credit) is vital. High utilization suggests financial strain and increases perceived risk.

- Monitor credit reports regularly: Regularly reviewing credit reports helps identify and address any errors or fraudulent activity that could negatively affect credit scores.

- Maintain a mix of credit accounts: A diverse range of credit accounts (credit cards, installment loans) demonstrates responsible credit management, potentially boosting credit scores.

- Consider a secured credit card: A secured credit card requires a security deposit, reducing the lender’s risk and providing an opportunity to build credit history.

Analyzing the Impact of Different Credit Risk Levels

Understanding the impact of different credit risk levels on loan approvals is crucial for both lenders and borrowers. Lenders use credit risk assessments to determine the likelihood of loan repayment, influencing their approval decisions and the terms offered. Borrowers, in turn, experience varying financial implications depending on their creditworthiness.

Credit risk is categorized into low, medium, and high levels, each carrying distinct consequences. Low-risk borrowers generally have excellent credit scores and histories, indicating a high probability of repayment. Medium-risk borrowers exhibit a moderate level of risk, while high-risk borrowers present a significantly higher chance of default. This categorization directly impacts loan approval rates and the associated financial terms.

Loan Approval Rates Across Credit Risk Levels

Low-risk borrowers typically enjoy significantly higher loan approval rates compared to medium and high-risk borrowers. Lenders are more willing to approve loans for individuals with established creditworthiness, often offering favorable terms. Medium-risk borrowers face a lower approval rate, while high-risk borrowers may find it considerably more challenging to secure loans. The difference in approval rates reflects the lender’s assessment of the probability of default.

For example, a lender might approve 90% of low-risk loan applications, 60% of medium-risk applications, and only 20% of high-risk applications. These figures are illustrative and can vary based on numerous factors including the lender’s policies and the prevailing economic climate.

Financial Implications for Borrowers with Different Credit Risk Profiles

Borrowers’ credit risk profiles directly impact the cost and terms of their loans. Low-risk borrowers generally secure loans with lower interest rates, more favorable repayment terms, and potentially higher loan amounts. Medium-risk borrowers may face higher interest rates, shorter repayment periods, and potentially lower loan amounts. High-risk borrowers often encounter significantly higher interest rates, stricter lending criteria, and may be required to provide additional collateral or guarantees to secure a loan.

The cumulative effect of these differences can result in substantial variations in the total cost of borrowing. For example, a low-risk borrower might obtain a 5% interest rate on a 30-year mortgage, while a high-risk borrower might receive a 10% rate on a 15-year mortgage, substantially increasing the total interest paid.

Lender Differentiation Based on Assessed Credit Risk

Lenders employ various strategies to differentiate their lending practices based on credit risk. This includes adjusting interest rates, loan amounts, and repayment terms according to the borrower’s risk profile. They might also require additional collateral or co-signers for higher-risk borrowers. Furthermore, lenders often use sophisticated credit scoring models and risk assessment tools to refine their decision-making process.

For instance, some lenders might offer specialized loan products tailored to specific risk segments, such as subprime mortgages for high-risk borrowers, albeit with significantly higher interest rates and fees. Others might use automated underwriting systems to streamline the loan application process based on pre-defined risk parameters.

Loan Terms Across Different Credit Risk Categories

| Credit Risk Level | Interest Rate | Loan Amount | Repayment Term |

|---|---|---|---|

| Low | 4-6% | High (e.g., $500,000 for a mortgage) | Long (e.g., 30 years for a mortgage) |

| Medium | 7-9% | Medium (e.g., $300,000 for a mortgage) | Medium (e.g., 20 years for a mortgage) |

| High | 10% or higher | Low (e.g., $100,000 for a mortgage) | Short (e.g., 15 years for a mortgage) |

In conclusion, the impact of credit risk on loan approval is undeniable. From initial application to final loan terms, a borrower’s creditworthiness significantly shapes the lending decision. Understanding the various facets of credit risk—including credit scores, history, and debt management—is crucial for both borrowers seeking favorable loan terms and lenders aiming to mitigate potential financial losses. By proactively managing their credit profiles, individuals can significantly improve their chances of securing loans at competitive interest rates.

Responsible lending practices, informed by a thorough credit risk assessment, ultimately contribute to a healthier and more stable financial ecosystem.

FAQ Compilation

What is a good credit score for loan approval?

Generally, a credit score above 700 is considered good and increases your chances of loan approval with favorable terms. However, the specific score required varies depending on the lender and loan type.

How long does it take to improve my credit score?

Improving your credit score takes time and consistent effort. It’s a gradual process, and you might see improvements within 6-12 months with consistent responsible financial behavior.

Can I get a loan with bad credit?

Yes, but it’s more challenging. You might qualify for loans with higher interest rates or stricter terms. Consider seeking guidance from a credit counselor.

What happens if I miss a loan payment?

Missing a payment negatively impacts your credit score and can lead to late fees, increased interest rates, and potential account delinquency.