In today’s digital landscape, credit card fraud poses a significant threat. Millions fall victim each year to sophisticated schemes designed to steal personal and financial information. Understanding these tactics, however, empowers consumers to take proactive steps towards safeguarding their finances. This guide provides practical strategies and crucial knowledge to help you navigate the complexities of credit card security and protect yourself from potential fraud.

From recognizing the warning signs of phishing emails to utilizing advanced security features offered by credit card companies, we’ll explore a comprehensive range of protective measures. We’ll delve into the different types of credit card fraud, examining real-world examples to illustrate the potential consequences and preventative actions you can take. Learning to monitor your accounts diligently and reporting suspicious activity promptly are equally vital components of a robust security strategy.

Ultimately, this guide aims to equip you with the tools and knowledge to confidently manage your credit card information and minimize your risk of becoming a victim of fraud.

Understanding Credit Card Fraud

Credit card fraud is a significant problem, costing individuals and businesses billions of dollars annually. Understanding the various types of fraud and the methods employed by criminals is crucial for effective prevention. This section will explore the different facets of credit card fraud, providing examples and outlining preventative measures.

Types of Credit Card Fraud

Credit card fraud encompasses a wide range of illegal activities. These can be broadly categorized based on how the fraud is committed and who is the target. The most common types include application fraud, account takeover, card-not-present fraud, and card-present fraud.

Methods Used by Fraudsters

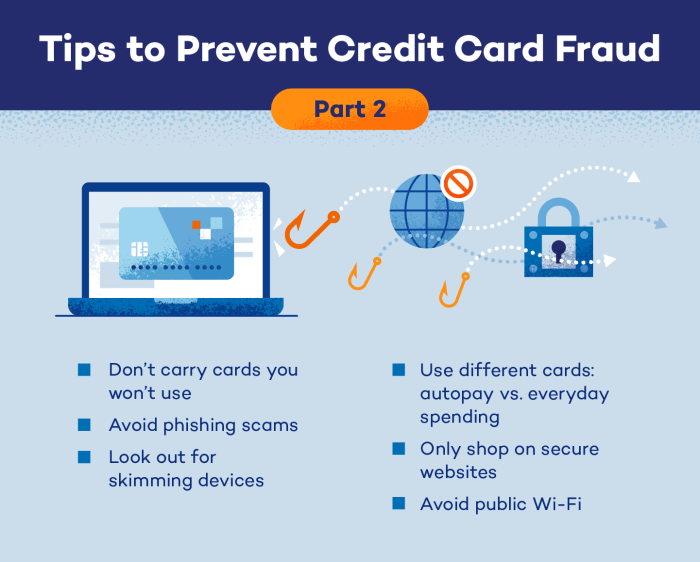

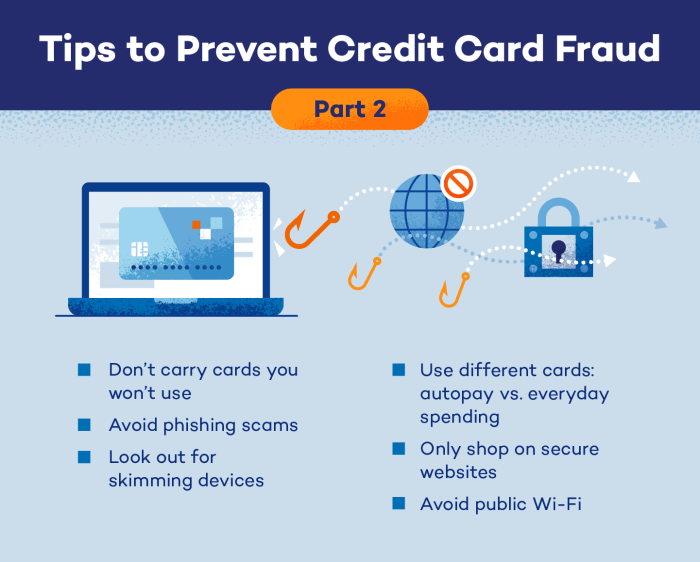

Fraudsters employ increasingly sophisticated techniques to perpetrate their crimes. Common methods include phishing scams (where victims are tricked into revealing their card details), skimming (copying card information from physical cards), malware (installing malicious software on computers to steal data), and data breaches (targeting businesses to steal large amounts of customer data). They may also use stolen identities to apply for new credit cards or take over existing accounts.

Real-World Credit Card Fraud Scenarios

Consider these examples: A phishing email appearing to be from a legitimate bank prompts a user to enter their credit card details on a fake website. A compromised point-of-sale system at a restaurant allows a thief to steal card information from multiple customers. An individual’s credit card details are stolen from a breached online retailer’s database and used for unauthorized purchases.

A physical credit card is skimmed at an ATM, enabling the thief to clone the card and make fraudulent transactions.

Comparison of Credit Card Fraud Types

| Fraud Type | Description | Impact | Prevention Methods |

|---|---|---|---|

| Application Fraud | Fraudulent application for a new credit card using stolen identity. | Financial loss, damaged credit score. | Regularly check credit reports, use strong passwords, be cautious of unsolicited offers. |

| Account Takeover | Unauthorized access to an existing credit card account. | Unauthorized purchases, potential identity theft. | Use strong passwords, monitor account activity regularly, report suspicious transactions immediately. |

| Card-Not-Present Fraud | Fraudulent transactions where the physical card is not present (e.g., online purchases). | Financial loss. | Use secure websites, monitor online statements, utilize virtual credit card numbers. |

| Card-Present Fraud | Fraudulent transactions where the physical card is present (e.g., skimming). | Financial loss. | Be cautious of suspicious ATMs or POS terminals, shield PIN when entering it, regularly check credit card statements. |

Protecting Yourself from Credit Card Fraud

Credit card fraud is a significant concern in today’s digital age. Protecting your financial information requires vigilance and proactive measures. By implementing robust security practices both online and offline, you can significantly reduce your risk of becoming a victim. This section Artikels practical steps you can take to safeguard your credit cards and personal information.

Securing Online Transactions

Safeguarding online transactions involves a multi-layered approach. Always verify the website’s security before entering any sensitive information. Look for the padlock icon in the address bar and ensure the URL begins with “https.” Avoid using public Wi-Fi for financial transactions as these networks are often vulnerable to interception. When shopping online, favor reputable retailers with established security protocols.

Be wary of unsolicited emails or text messages requesting personal or financial details, as these are often phishing attempts.

Strong Passwords and Password Management

Employing strong, unique passwords for each online account is crucial. A strong password should be at least 12 characters long, combining uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like birthdays or pet names. A password manager can help you generate and securely store complex passwords, eliminating the need to remember them all. Regularly update your passwords, especially for accounts containing sensitive financial information.

Consider using multi-factor authentication (MFA) whenever available, adding an extra layer of security.

Benefits of Virtual Credit Card Numbers

Virtual credit card numbers (VCCs) offer a significant advantage in online security. A VCC is a temporary credit card number generated by your bank, linked to your primary account but with a unique number and expiration date. Using a VCC for online purchases isolates your actual credit card number, limiting the potential damage if a website is compromised.

If a VCC is compromised, you can simply cancel it without affecting your primary card. Many banks offer VCC services as a free or low-cost feature.

Security Measures Checklist for Everyday Credit Card Usage

Implementing a comprehensive security checklist is vital for minimizing fraud risks.

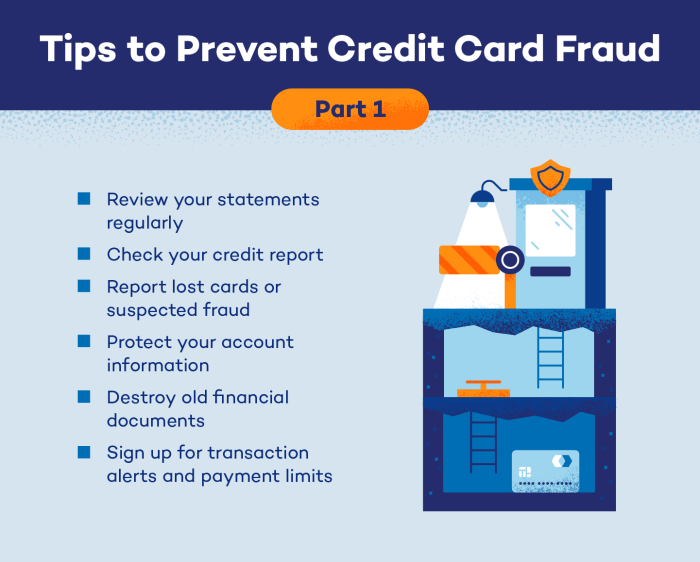

- Regularly review your credit card statements for any unauthorized transactions.

- Report suspicious activity immediately to your bank.

- Keep your credit card information secure and do not share it unnecessarily.

- Shred any documents containing your credit card number before discarding them.

- Be cautious when using ATMs and POS terminals, ensuring they appear secure and legitimate.

- Notify your bank of any upcoming travel plans to prevent your card from being blocked.

- Consider using contactless payment options only when confident about the security of the terminal.

Monitoring Credit Card Statements for Suspicious Activity

Regularly monitoring your credit card statements is a cornerstone of fraud prevention. Ideally, review your statement online immediately upon its availability. Pay close attention to transaction details, including dates, merchants, and amounts. Any unfamiliar transactions should be flagged immediately. If you discover unauthorized charges, contact your bank or credit card issuer without delay to report the fraudulent activity and initiate a dispute.

Many banks offer mobile apps that allow for real-time transaction monitoring and alerts. For example, a sudden large purchase at an unfamiliar merchant could indicate fraudulent activity. Another example would be multiple small transactions from locations you haven’t visited. Prompt reporting is critical to minimizing financial losses.

Protecting yourself from credit card fraud requires a multi-faceted approach combining vigilance, proactive security measures, and prompt action in the event of suspected fraud. By understanding the various methods employed by fraudsters, implementing strong security practices, and regularly monitoring your accounts, you significantly reduce your vulnerability. Remember, reporting any suspicious activity immediately is crucial in mitigating potential financial losses.

Staying informed and adopting these protective strategies will empower you to maintain control over your financial well-being in an increasingly digital world.

Quick FAQs

What should I do if I suspect a fraudulent transaction?

Immediately contact your credit card issuer to report the suspicious activity. Then, review your recent transactions carefully and dispute any unauthorized charges.

How often should I check my credit card statement?

It’s recommended to review your statement at least once a month, or even more frequently if you make many online purchases.

Are all online shopping sites equally secure?

No. Always verify that a website uses HTTPS and look for security indicators such as a padlock icon in the address bar. Be wary of unfamiliar or poorly designed websites.

What is EMV chip technology, and how does it help?

EMV (Europay, MasterCard, and Visa) chips encrypt transaction data, making it more difficult for fraudsters to clone or counterfeit cards.