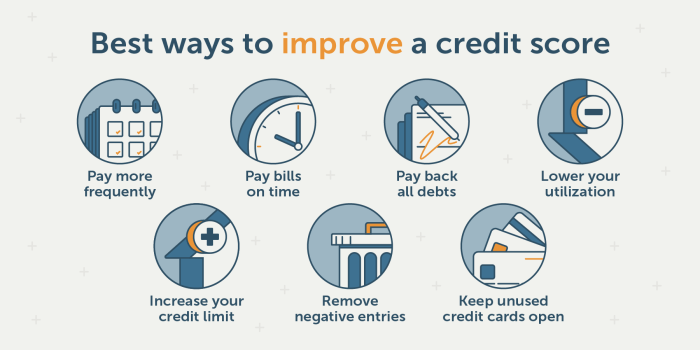

Improving your credit score can feel like a daunting task, but with a strategic approach and consistent effort, you can see significant improvements relatively quickly. This guide breaks down the key components of your credit score, offering actionable steps to boost your rating and achieve your financial goals. We’ll explore proven methods for managing debt, utilizing credit cards responsibly, and building a positive credit history—all designed to help you navigate the complexities of credit scoring and achieve a healthier financial future.

Understanding your credit score is the first step. It’s a numerical representation of your creditworthiness, impacting your ability to secure loans, rent an apartment, or even obtain certain jobs. Factors like payment history, amounts owed, and length of credit history all play a crucial role. By addressing these areas strategically, you can positively influence your score and unlock better financial opportunities.

Understanding Your Credit Score

Your credit score is a three-digit number that lenders use to assess your creditworthiness. A higher score indicates a lower risk to lenders, resulting in better interest rates and loan terms. Understanding the components of your credit score is crucial to improving it. This section will break down the key factors influencing your score and provide actionable strategies for improvement.

Credit Score Components and Their Impact

Your credit score is calculated using a weighted average of several key factors. While the specific weights can vary slightly between scoring models (like FICO and VantageScore), the components remain consistent. Understanding how each component contributes to your overall score is essential for targeted improvement.

| Component | Weight (Approximate) | Positive Impact | Negative Impact |

|---|---|---|---|

| Payment History | 35% | Consistent on-time payments on all credit accounts (credit cards, loans, etc.). A long history of on-time payments significantly boosts your score. | Late payments, missed payments, and defaults severely damage your score. Even one missed payment can have a significant negative impact. Collection accounts and bankruptcies have a particularly strong negative impact. |

| Amounts Owed | 30% | Keeping your credit utilization ratio (the amount you owe compared to your available credit) low (ideally below 30%). Paying down balances regularly demonstrates responsible credit management. | High credit utilization ratios indicate a higher risk to lenders. Maxing out credit cards or consistently carrying high balances negatively impacts your score. Having multiple accounts with high balances is particularly damaging. |

| Length of Credit History | 15% | Maintaining older credit accounts in good standing. A longer credit history demonstrates a proven track record of responsible credit use. This is often why it’s advisable to keep your oldest credit card open, even if you don’t use it regularly. | Closing older accounts, especially those with a long history of on-time payments, can shorten your credit history and negatively affect your score. Frequent applications for new credit can also shorten the average age of your accounts. |

| New Credit | 10% | Applying for credit infrequently. Responsible use of new credit demonstrates financial stability. | Applying for multiple credit accounts in a short period can significantly lower your score. This signals to lenders that you may be overextending yourself financially. Hard inquiries on your credit report, generated when lenders check your credit, can also negatively affect your score, though the impact is usually temporary. |

| Credit Mix | 10% | Having a diverse range of credit accounts (e.g., credit cards, installment loans, mortgages). This demonstrates experience managing different types of credit. | Having only one type of credit account can negatively impact your score. However, the impact of credit mix is relatively small compared to other factors. It’s more important to focus on responsible credit management across all your accounts. |

Dispute Errors on Your Credit Report

A surprisingly common path to a higher credit score involves actively reviewing and correcting inaccuracies on your credit reports. Errors can significantly impact your score, so identifying and disputing them is a crucial step in improving your financial standing. Even small mistakes can have a large effect on your creditworthiness.

Obtaining Your Credit Reports

You are entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year through AnnualCreditReport.com. This is the only official website authorized by the federal government to provide free reports. Avoid sites that claim to offer free credit reports but require payment or personal information beyond what’s needed for verification.

The process typically involves providing some personal information to verify your identity. You’ll then receive your report electronically or by mail, depending on your preference.

Identifying and Disputing Inaccurate Information

Once you receive your credit reports, carefully review each one for inaccuracies. Look for accounts that aren’t yours, incorrect balances, late payments that you didn’t make, or incorrect personal information like your address or date of birth. Any discrepancy, no matter how seemingly small, should be investigated. If you find an error, you need to formally dispute it with the respective credit bureau.

Each bureau provides a dispute process, usually online through their website. This generally involves filling out a form detailing the inaccurate information and providing supporting documentation, such as proof of payment or a copy of your bank statement.

Examples of Common Credit Report Errors and Their Correction

Common errors include accounts listed that aren’t yours (identity theft), incorrect payment history (missed payments you made on time), and outdated or inaccurate personal information. For example, if an account shows a late payment when you have proof you paid on time, you would provide that proof to the credit bureau. Similarly, if your address is incorrect, provide documentation like a driver’s license or utility bill with the correct address.

For accounts that aren’t yours, you’ll need to provide evidence to support your claim. This might include a police report if you suspect identity theft. The credit bureau is obligated to investigate your claim and correct the error if they find it to be valid.

Sample Dispute Letter

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address][Date]

[Credit Bureau Name]

[Credit Bureau Address]Subject: Dispute of Inaccurate Information on Credit Report – Account [Account Number]

Dear [Credit Bureau Name],This letter is to formally dispute inaccurate information on my credit report. Account number [Account Number] shows [Inaccurate Information, e.g., a late payment on July 15th]. I have enclosed [Supporting Documentation, e.g., proof of payment] as evidence that [Correct Information, e.g., the payment was made on time]. Please investigate this matter and correct the inaccurate information on my credit report.

Sincerely,

[Your Signature]

[Your Typed Name]

Paying Down Debt

Tackling high debt is crucial for improving your credit score. High credit utilization (the percentage of your available credit you’re using) significantly impacts your score. Reducing your debt lowers this percentage, signaling responsible credit management to lenders. This section explores effective strategies for debt reduction and the importance of planning.Effective strategies for reducing high credit card balances involve a combination of disciplined spending and strategic repayment methods.

Prioritizing high-interest debt while minimizing new borrowing is key. Careful budgeting allows you to allocate more funds towards debt repayment, accelerating the process.

Debt Repayment Methods

Choosing the right debt repayment method can significantly impact your progress. Two popular methods are the debt snowball and the debt avalanche methods. The debt snowball method focuses on paying off the smallest debt first, regardless of interest rate, for psychological motivation. The debt avalanche method prioritizes paying off the debt with the highest interest rate first, to minimize total interest paid.The debt snowball method offers a psychological advantage.

Seeing quick wins by paying off smaller debts can boost motivation and maintain momentum throughout the repayment journey. However, it may cost more in interest in the long run compared to the debt avalanche method. The debt avalanche method, while potentially more expensive initially, saves money on interest in the long run. It’s mathematically the most efficient approach, but requires strong discipline to stick with it despite slower initial progress.

Budgeting and Debt Repayment Planning

A well-structured budget is the cornerstone of any successful debt repayment plan. By tracking income and expenses, you can identify areas where you can cut back and allocate more funds toward debt repayment. This process helps you visualize your financial situation and create a realistic plan you can stick to. A detailed plan Artikels specific amounts to be paid to each creditor each month.

This ensures consistency and accelerates debt reduction. Without a plan, progress can be erratic and motivation can wane.

Sample Debt Repayment Plan

The following table illustrates a sample debt repayment plan. Remember to adjust this based on your individual circumstances and financial situation. Prioritize higher interest debts if using the debt avalanche method.

| Creditor | Balance | Minimum Payment | Planned Payment |

|---|---|---|---|

| Credit Card A | $1,500 | $50 | $100 |

| Credit Card B | $500 | $25 | $75 |

| Personal Loan | $3,000 | $100 | $150 |

Managing Credit Card Use

Credit card usage significantly impacts your credit score. Understanding how credit utilization and responsible spending habits affect your creditworthiness is crucial for improving your score quickly. This section will Artikel best practices for managing your credit cards to maximize their positive influence on your credit profile.

Your credit utilization ratio is a key factor in your credit score calculation. This ratio represents the percentage of your total available credit that you are currently using. Lenders view a high utilization ratio as a sign of potential financial instability, leading to a lower credit score. Conversely, a low utilization ratio demonstrates responsible credit management, positively impacting your score.

Credit Utilization and Credit Score Relationship

A lower credit utilization ratio is strongly correlated with a higher credit score. Credit scoring models generally penalize high utilization, often considering anything above 30% as unfavorable. Aiming for a utilization ratio below 10% is generally considered ideal, though maintaining a ratio below 30% is a good target for most people. The impact of utilization isn’t linear; the penalty for exceeding 30% increases significantly.

For example, a person with a $10,000 credit limit who carries a $3,000 balance has a 30% utilization rate, while someone with the same limit carrying a $1,000 balance has a much more favorable 10% utilization rate. The latter will generally see a higher credit score.

Best Practices for Responsible Credit Card Usage

Responsible credit card usage involves more than just paying your bills on time. It includes strategic spending and consistent monitoring of your credit utilization.

Several best practices contribute to maintaining a healthy credit profile. These include regularly reviewing your credit report for errors, paying your credit card balances in full each month whenever possible, and keeping the number of credit cards you actively use to a manageable amount. Avoid opening numerous new accounts in a short period, as this can negatively affect your credit score.

Furthermore, consistently monitoring your credit utilization helps you proactively adjust your spending habits to keep your ratio low.

Examples of Actions Minimizing Negative Impacts

Several actions directly minimize the negative impact of credit card use on your credit score. Paying your balance in full and on time each month prevents late payment fees and negative marks on your credit report. This is the single most effective action you can take. Keeping your credit utilization low, ideally below 30%, shows lenders you’re managing your debt responsibly.

Avoid opening multiple new credit cards in a short period, as this can lower your average credit age and negatively impact your score. If you’re struggling to keep your utilization low, consider paying down existing debt or requesting a credit limit increase from your card issuer (if you qualify).

Calculating Credit Utilization and Its Effect

Calculating your credit utilization is straightforward. It’s simply the total amount of credit you’re using divided by your total available credit, multiplied by 100 to express it as a percentage.

Credit Utilization = (Total Credit Used / Total Available Credit) – 100

For example: If you have a total credit limit of $5,000 across all your cards and you currently owe $1,500, your credit utilization is (1500/5000)100 = 30%. A 30% utilization rate is considered high and may negatively affect your credit score. Reducing your debt to $500 would lower your utilization to 10%, significantly improving your credit profile. Reducing your credit utilization even further, to below 10%, will likely yield additional positive impacts on your credit score.

Building Positive Credit History

Establishing a positive credit history is crucial for securing loans, renting an apartment, and even getting certain jobs. A strong credit history demonstrates your responsible financial behavior to lenders and other institutions. For those starting out or with limited credit, building this history requires proactive steps and a commitment to responsible financial management.

Establishing Credit with Limited History

Building credit from scratch can seem daunting, but several strategies can help. One effective method is to become an authorized user on a credit card account held by someone with a strong credit history. Another approach involves applying for a secured credit card, which requires a security deposit to mitigate lender risk. Finally, consistently paying all bills on time, even small ones like utility bills, can positively impact your credit report over time, contributing to a positive payment history.

Responsible use of credit products, coupled with consistent on-time payments, lays the foundation for a healthy credit profile.

Benefits of Authorized User Status

Becoming an authorized user on a credit card account with a long history of responsible use can significantly boost your credit score. The authorized user benefits from the account’s positive payment history, which is reported to credit bureaus. This “piggybacking” approach provides a shortcut to establishing credit, especially for individuals with limited or no credit history. However, it’s crucial to ensure the primary account holder has a strong credit history and maintains responsible spending habits to maximize the positive impact.

For example, if a parent with excellent credit adds their child as an authorized user, the child can benefit from the positive payment history of the parent’s established account.

Applying for a Secured Credit Card

A secured credit card requires a security deposit that serves as collateral. This deposit typically equals your credit limit. The advantage is that it’s easier to obtain than an unsecured card, even with limited or no credit history. Responsible use of a secured card, including making on-time payments and keeping your credit utilization low, demonstrates creditworthiness and can lead to an upgrade to an unsecured card after a period of consistent good behavior.

For instance, a person with no credit history might deposit $500 to obtain a $500 secured credit card. By responsibly using and paying off this card, they can build a positive credit history and potentially qualify for an unsecured card later.

A Step-by-Step Guide to Responsible Credit Building

Building credit responsibly is a gradual process that demands careful planning and consistent effort. Here’s a step-by-step guide:

- Check your credit report: Obtain your free credit report from AnnualCreditReport.com to identify any errors and understand your current credit standing.

- Become an authorized user (if possible): Ask a trusted family member or friend with excellent credit if they would add you as an authorized user on their credit card.

- Apply for a secured credit card: If authorized user status isn’t an option, apply for a secured credit card. Choose a card with reasonable fees and interest rates.

- Use your credit card responsibly: Keep your credit utilization low (ideally below 30% of your credit limit). Pay your balance in full and on time each month.

- Monitor your credit score: Regularly check your credit score to track your progress and identify any potential issues.

- Diversify your credit: After establishing a good history with a credit card, consider applying for other credit products, such as a small personal loan, to further diversify your credit profile.

- Maintain good financial habits: Consistently pay all your bills on time, regardless of whether they impact your credit score directly. This demonstrates responsible financial behavior.

Credit Card, Credit Risk, and Credit Score Interrelation

Credit cards are a double-edged sword: they offer convenience and financial flexibility, but also present significant risks if not managed responsibly. Understanding the intricate relationship between credit cards, credit risk, and your credit score is crucial for building and maintaining strong financial health. This section explores how your credit card usage directly impacts your creditworthiness and how lenders use this information to assess your risk.Credit cards and credit risk are intrinsically linked.

When you apply for a credit card, the issuer assesses your creditworthiness to determine the likelihood of you repaying your debt. This assessment forms the basis of your credit risk – the potential for financial loss the lender faces if you default on your payments. A higher credit risk translates to less favorable credit card terms (higher interest rates, lower credit limits) or even rejection of your application.

Conversely, a lower credit risk profile often results in better offers and terms.

Credit Card Usage and Credit Score Impact

Your credit card usage significantly influences your credit score. Responsible credit card management, characterized by consistent on-time payments, low credit utilization (keeping your spending below 30% of your available credit), and a long credit history, contributes positively to your score. Conversely, missed payments, high credit utilization, and frequent applications for new credit negatively impact your score. For instance, consistently paying your balance in full and on time demonstrates responsible borrowing behavior, leading to a higher credit score.

In contrast, frequently maxing out your credit card or making late payments signals to lenders a higher risk of default, resulting in a lower score. Credit bureaus like Experian, Equifax, and TransUnion utilize sophisticated algorithms to assess these factors.

Lender Assessment of Credit Risk

Lenders use credit scores and credit card history as key indicators of credit risk. A higher credit score indicates a lower risk of default, making you a more attractive borrower. Lenders examine several factors from your credit report, including your payment history (the most significant factor), amounts owed, length of credit history, credit mix (variety of credit accounts), and new credit (recent applications).

Your credit card history, specifically your payment behavior and credit utilization, is a central component of this assessment. For example, a consistently high credit utilization ratio (the percentage of available credit used) suggests you may be overspending and struggling to manage your debt, increasing your perceived credit risk.

Comparison of Credit Card Types and Their Impact on Credit Scores

Different types of credit cards can impact your credit score in varying ways. Secured credit cards, which require a security deposit, are often easier to obtain for individuals with limited or damaged credit. While they can help build credit history, they may not offer the same rewards or benefits as unsecured cards. Unsecured credit cards, offered to individuals with established credit, typically come with higher credit limits and more attractive rewards programs.

However, the higher credit limit can also lead to increased risk if not managed responsibly. Premium credit cards, often requiring high credit scores and annual fees, offer significant rewards and benefits but carry a higher risk of accumulating debt if not used cautiously. The impact on your credit score is largely dependent on your responsible use of the card, regardless of the type.

For example, even a premium card can negatively affect your score if you consistently carry a high balance or make late payments.

Ultimately, improving your credit score is a journey that requires dedication and consistent effort. By understanding the key components of your credit report, actively managing your debt, and practicing responsible credit card usage, you can significantly improve your financial standing. Remember, building a strong credit history takes time, but the rewards of improved access to credit and potentially lower interest rates are well worth the effort.

Take control of your financial future—start improving your credit score today!

Answers to Common Questions

What is a good credit score?

Generally, a credit score above 700 is considered good, while a score above 800 is excellent. However, the specific thresholds can vary depending on the scoring model used.

How often should I check my credit report?

You’re entitled to a free credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. Checking regularly helps you identify and address any errors promptly.

Can I improve my credit score immediately?

While significant improvements take time, you can take immediate steps like paying down debt and disputing any inaccuracies on your credit report to start the process.

What if I have no credit history?

Consider applying for a secured credit card or becoming an authorized user on a trusted individual’s account to start building your credit history.